|

Are you really above the average? Whether or not you are, you are happier! Optimism leads to success and overall more happiness.

0 Comments

Entrepreneur lesson numbers 1, 2 and 3. I thought that when I became self-employed I would have loads of time to do everything and that my life would just open up. I also thought that as a small business owner it is my duty to be prudent and not to spend ANY money on staff. I have heard other business owners talk about the importance of not trying to do everything yourself and thought, "If you're a small business, you need to do everything yourself." This is very wrong, very very wrong! Two months into my business, I have found that social networking is important to drive traffic to my websites but it takes tonnes and tonnes of time!! Geez, I have spent so much time posting links of blogs I have just written to various sites instead of spending that time either making phone calls, writing more great copy or coming up with new strategies. My time is not being well spent! Secondly, nowadays you don't need to spend a fortune to have an assistant. You can actually pay a very decent fair wage to a virtual assistant to whom you assign all tasks that can be passed on. This is great! Why have I not been using this technology all along?! I'll tell you why: because I hadn't read the Four Hour Work Week by Tim Ferris yet so I didn't know that I could be making use of such a service. My assistant starts on Monday! First things first, what is a virtual assistant? An assistant that works remotely. She isn't in the same office as you. You could be in New York whilst she works from London. In my case, she's a pretty lady called Uneza in India. She is a university graduate. So, how does one go about assigning tasks to such a person? 1. Decide what you are not good at doing: I am not good at admin and other such repetitive tasks e.g. putting my receipts into a spreadsheet. I save all of them in a directory as PDFs easily enough but find it hard to make the extra effort to put them all neatly into Excel. 2. Decide what is not cost efficient for you to do: Once I have decided on a social marketing strategy e.g. post links to "such-and-such" a new hot social network to be, I do not need to be doing this myself. It can be passed on. I can respond to follow-on comments if they require specialist knowledge but other than that anyone can do that work. Social networks are a time vortex: you will always find something to distract you and if you want to have oversight, allocate an hour at the end of the day. Don't get lost in them. 3. Decide things you don't want to do: See one and two - I don't want to be doing any of that. In addition, I frequently need to dig up emails or information on something - one does not have to do one's own websurfing. 4. Decide on repetitive tasks that can easily be passed on: Most things are repetitive e.g. data exercises, formatting tasks or copy-and-paste jobs. These things are ripe for passing on to an assistant and anyone that looks closely at their to-do list will see there are many repeat tasks that can be done by anyone that has a computer. I cannot wait for my VA to start. Feedback will follow. Lessons: 1. Tempus fugit - time flies and it flies even faster if you are a business owner. 2. Value your time. You might make more money if you spend some effectively increasing the quantity of yourself available with an assistant. 3. Your assistant could be sat in another country entirely, they do not have to be present. In fact, more might be achieved if they are not present.

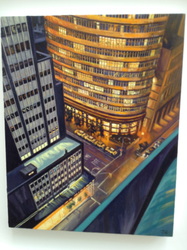

The 2012 summer exhibition at the Royal Academy of Arts is fabulous. Although there are some pieces there that make you wonder about the entry requirement, there are many more intriguing/creative pieces. Tracey Emin had a completely useless piece of 'art' there for £165,000; perhaps someone with all money and no sense will buy it but I am hoping that no one is that stupid.

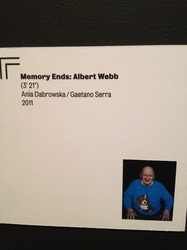

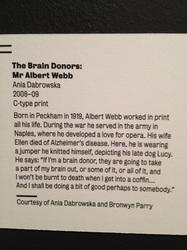

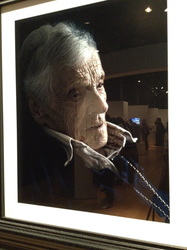

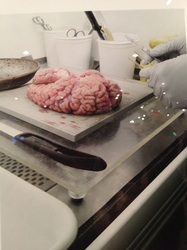

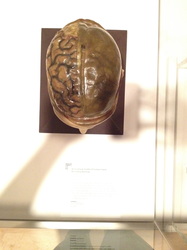

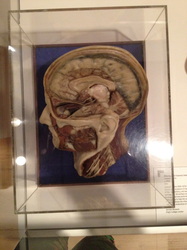

Apparently some people have been fainting at the "Brains: The Mind as Matter" Exhibition at the Wellcome Trust because they can't stomach some of the exhibits. In particular, there is a video of brain surgery in action from the 1940s/50s and another of shock treatment from the same sort of period. I wasn't fazed by either - I'm made of stern stuff, I guess. That said, it did get me thinking. Are younger generations of Brits unable to deal with reality? They grew up without seeing animals or other "real" life; if you grew up on or near a farm you likely wouldn't get squeamish over the sight of a few innards. You'd have seen at least a chicken being killed and cows being milked and wouldn't get distressed by the sight of a brain or two. I don't know. I really enjoyed the portraits of people who have donated their brains for research, it really humanised the whole thing. Would you donate your brain for research? I am thinking it's a good idea...but I am yet to fully decide.

This blog is inspired by Christopher McDougall's book, Born to Run Until today, I always believed that women sat around tending to the kids as the men went out hunting and "brought the bacon" home. I don't think I learnt this at school, it's just one of those things I knew, you know - "general knowledge". Then, as I was reading Born to Run I learnt that scientists can almost conclusively say that when we were hunter-gatherers the women were part of the chase. For instance, in most mammals, the male is much larger than the female. In human beings on the other hand, the male is on average only 15% larger than the female as we're both designed for the same function: running. Our small nimble size is ideally suited to long chases. Human beings are designed to endure very long runs in pursuit of their prey - meat for food. I once read of a woman who had a baby and went out to complete a marathon the very next (or same) day. I thought she was mad but apparently it's not so crazy. Hunter-gatherer women were exactly the same way; running was not some big thing that you had to go and do. It was a way of life - something you did everyday, kind of like waking up and watching TV in today's world. Is there any evidence for this way of life? In fact there is. Modern societies and the digital revolution remain very new. Hunter-gatherer societies still exist. The Mbuti or Bambuti pygmies in the Congo maintain their hunter-gatherer way of life. Both men and women gather and forage. When it comes to hunting for meat, the women and children take part by 'driving the prey into the nets' (Wikipedia).  This driving the prey into the nets is made to sound like a light activity but it's actually a wild chase of man versus animal that can last hours at a time. A group of 6-10 people collectively target and outrun a deer until it's tired out. When they catch it, the kill is taken back to the community and shared collectively. The Mbuti live in groups of 15-60 and total 30- to 40,000 worldwide. They have developed hunting boundaries so that one group doesn't impinge on the ground of another. I expect that this is as much for sustainability as it is for maintaining the peace. Ultimately, people who live this sort of nomadic lifestyle live as one large family. Everything is shared. I kind of envy this way of life. In modern society it's every man for himself: eat or be eaten. On the issue of running. There is an ultra running competition every year, the Leadville Trail 100. Ultra running is running on very rough terrain, on routes where cars can't pass. It's been found that although men can out-sprint women over short distances, when it come to ultra races like the Leadville, 90% of women finish but only 50% of men do. The book didn't drill down on why this phenomenon exists but it serves as further evidence that we were both designed to persevere and persist over hard terrain for long distances. Born to Run is a book about running but I decided to zone in on the issue of women for this post. I have reviewed the book here and written more about the book from a different angle in these posts: I highly recommend this book.

My cousin posted this video on her blog. I was so touched (almost cried but I'm made of stern stuff!) that I had to put it up too! It's about not giving up. At the bottom I add one of my favourite poems, When things go wrong as they sometimes will; I used to have the poem hanging up in my room as a teen. When things go wrong as they sometimes will, When the road you are trudging seems all uphill; When the funds are low, and the debts are high, And you want to smile, but you have to sigh; When care is pressing you down a bit - Rest if you must, but don't you quit. Life is queer with its twists and turns, As every one of us sometimes learns; And many a fellow turns about When he might have won, had he struck it out; Don't give up though the pace seems slow; You may well succeed with another blow. Often the goal is nearer than It seems to a faint and faltering man; Often the struggler has given up When he might have captured the Victor's cup! And he learned too late, when the night came down, How close he was to the golden crown. Success is failure turned inside out, The silver tint of the clouds of doubt. And you never can tell how close you are If may be near, when it seems afar. So stick to the fight when you are hardest hit, It is when things seem worst that you must not quit. Author : Unknown

One of my friends asked me for advice on where to put his money. As a matter of principle, I don’t give investment advice to friends because I know that I would almost certainly lose a friend if that investment went sour. Importantly, I am not a professional asset manager. That said, I do invest for my own account so I am willing to give tips that I find beneficial. To top up my knowledge, I picked up a copy of The Intelligent Investor by Benjamin Graham but I personally didn’t find it useful so I decided to set out a few of my own tips for successful investing. I have invested successfully in the past. My best success was Apple: I bought Apple at $78 in 2006 and sold it at about $280 in the 2009. At the time I felt like a don and I didn’t hesitate to show off to my friends. I sold my shares at the high of that time but if I had known they would be hitting $600 some day I would have sat tight and braced the hard times. Never mind. Personally, this is how I invest in shares:  1. Buy low, sell high. The saying is a bit clichéd but the whole point of investing is to make as big a profit as possible; to this end, you need to sell higher than where you bought. With this in mind, I usually decide on which region of the world I want to invest in, so if it’s the UK I am interested in, I download Bloomberg data for a given UK index e.g. the FTSE 100, for the top 100 UK companies. I then sort the list by the 52 week low, divide that by the current price and see which shares are trading near their 52-week low. Trading at the 52-week low does not immediately mean I will buy that stock but it gives me a good starting point. I hate buying shares that are near their 52-week high because I psychologically think they are more likely to come down. That said, I will still look at the names of shares near the 52-week high carefully to consider if it’s a pattern that might continue. 2. Consider your time. If you don’t have time to pick stocks carefully and to monitor your portfolio periodically, get an investment advisor. 3. Consider your skills. Do you feel comfortable investing? You don’t need to have a background in finance to understand the stock market but you do need to pick up a few books to understand how it works. If you don’t think you have the necessary skill-set, get an investment advisor.  4. Think long-term. I am not into speculating. I might give speculation a go at some point but if so I would allocate a small, fixed budget for that purpose. I personally think that you are more likely to make successful investments if you are looking for a stock that will perform well in the long-run than if you are shooting for short-term, fast profits. 5. Look at how much debt the company has relative to how much they earn. Companies with high levels of debt are more likely to run into problems. If there is a good reason for the high leverage then you need not worry too much but you still need to be wary. 6. Look for companies that produce something. Call me old fashioned but I prefer to invest in companies that have a tangible product. A product that people actually want and need and will keep wanting and needing in large numbers for a long time to come. If I think it’s a fad, I will not invest. #Facebook?! 7. Don’t sell just because the going gets tough. Share prices go up and they go down. If a company has done a major wrong and you think it could lead to bankruptcy, get out whilst you can. If you think that the market is just overreacting, then sit tight and wait for recovery. 8. Decide on your selling rules. Decide on what price you want to sell your shares at and if it reaches that price, try not to change the rules unless there has been a fundamental change in the company’s strategy that warrants a change in your selling price. People lose money because they get carried away with a good run and think it will last forever. 9. Consider the dividend yield. If you are interested in the size of dividends that are going to be paid make sure to go for stocks that pay higher dividends. However, if you are young, or are in a high tax bracket you should be more interested in seeing your asset base grow. Dividends can be a great source of income when you are retired but are less necessary when you’re in employment and earning enough to cover your needs. 10. Read the news. In this day and age, there is no excuse for not being current with global news. Knowledge will guide your investments.

|

Archives

December 2015

Categories

All

By Heather Katsonga-WoodwardI'm always thinking, debating, considering and revising my views - some of those deliberations will be shared right here. |

RSS Feed

RSS Feed